* The preview only shows a few pages of manuals at random. You can get the complete content by filling out the form below.

Description

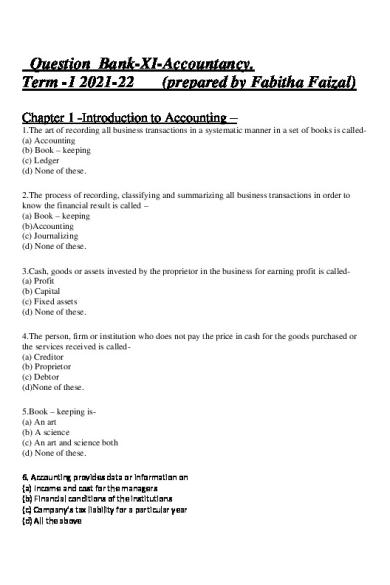

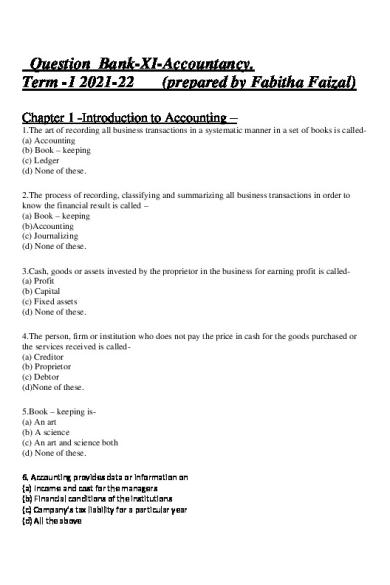

Question Bank-XI-Accountancy. Term -1 2021-22 (prepared by Fabitha Faizal) Chapter 1 -Introduction to Accounting – 1.The art of recording all business transactions in a systematic manner in a set of books is called(a) Accounting (b) Book – keeping (c) Ledger (d) None of these. 2.The process of recording, classifying and summarizing all business transactions in order to know the financial result is called – (a) Book – keeping (b)Accounting (c) Journalizing (d) None of these. 3.Cash, goods or assets invested by the proprietor in the business for earning profit is called(a) Profit (b) Capital (c) Fixed assets (d) None of these. 4.The person, firm or institution who does not pay the price in cash for the goods purchased or the services received is called(a) Creditor (b) Proprietor (c) Debtor (d)None of these. 5.Book – keeping is(a) An art (b) A science (c) An art and science both (d) None of these. 6. Accounting provides data or information on (a) Income and cost for the managers (b) Financial conditions of the institutions (c) Company’s tax liability for a particular year (d) All the above

7. In Accounts Recording Is Made Of: (a). Only Financial Transactions (b). Only Non-Financial Transactions (c). Financial And Non-Financial Transactions (d). Personal Transactions of The Proprietor 8. The Characteristics of Accounting Are: (a). Recording (b). Classifying (c). Summarizing (d). All of the above 9. The Objectives/Functions of Accounting Are: (a). To Ascertain Profit or Loss (b). What Should Be Done to Ascertain the Good State of Business? (c). To Provide Information’s to Various Parties (d). All of the above 10. The Objective/ Function of Accounting Is Not To: (a). Record The Transactions of Business (b). Record The Personal Transactions of The Proprietor (c). Ascertain The Profit or Loss of Business (d). Ascertain The Financial Position of The Business 11. Which of The Following Transactions Is Not of Financial Character? (a). Purchase of Asset on Credit (b). Purchase of Asset for Cash (c). Withdrawing Of Money by Proprietor from Business (d). Strike By Employees 12. Last Step of Accounting Process Is: (a). Who Provides Information to Parties Interested in Trade? (b). Record Transactions in The Books (c). What Should Be Done to Make a Summary in The Form of Statements? (d). What Should Happen to Classify the Transaction? 13. Internal Users of Accounting Information Are: (a). Potential Investors (b). Creditors (c). Management (d). Banks And Financial Institutions

14. External Users of Accounting Information Are (a). Researchers (b). Potential Investors (c). Government (d). All of the Above 15. Accounting Cycle Starts With: (a). Recording Of Transactions in Ledger (b). Recording Of Transactions in Journal (c). Preparing Trial Balance (d). Preparing Trading Account 16. Creditors of The Business Want to Know: (a). Profitability of the Business (b). What Should Be the Capacity of The Business to Pay Higher Salaries? (c). Creditworthiness Of the Business (d). Employment Opportunities 17. The Advantages of Accounting Are (a). Evidence In Court (b). Information Regarding Financial Position (c). Helpful In Decision Making (d). All Of These 18. Which of The Following Is Not the Advantage of Accounting? (a). Facilitates Settlement of Tax Liabilities (b). Comparative Study (c). Based On Accounting Concepts (d). Helpful In Decision Making 19. Which of The Following Is an Advantage of Accounting? (a). Based On Historical Costs (b). Omission Of Qualitative Information (c). Incomplete Information (d). Facilitates Sale of Business 20. The Limitations of Accounting are: (a). Influenced By Personal Judgements (b). Based On Historical Costs (c). Affected By Window-Dressing (d) All of above

21. Which of The Following Is Not the Limitation of Accounting? (a). Based On Accounting Conventions (b). Evidence In Legal Matters (c). Incomplete Information (d). Omission Of Qualitative Information’s

22. Users of Accounting Information’s Are (a). Owners Of Business (b). Management Of Business (c). Creditors (d). All Of the Above

23. Which One of The Following Is Not an Objective of Accounting? (a). Is It Appropriate to Provide Information About Liabilities? (b). What Should Be Done to Provide Information About the Profit of The Enterprise? (c). To Maintain Records of The Business (d). What Should Be Done to Provide Information About the Profit of The Enterprise.

24. Which of the following is not a business transaction? (a) Bought furniture of `10,000 for business (b). Paid for salaries of employees ` 5,000 (c). Paid son’s fees from her personal bank account ` 20,000 (d). Paid son’s fees from the business ` 2,000 25. Deepti wants to buy a building for her business today. Which of the following is the relevant data for his decision? (a) Similar business acquired the required building in 2000 for ` 10,00,000 (b) Building cost details of 2003 (c) Building cost details of 1998 (d) Similar building cost in August, 2005 ` 25,00,000 26. Which is the last step of accounting as a process of information? (a) Recording of data in the books of accounts (b) Preparation of summaries in the form of financial statements (c) Communication of information (d) Analysis and interpretation of information 27 Which qualitative characteristics of accounting information is reflected when accounting information is clearly presented? (a) Understandability (b) Relevance (c) Comparability

(d) Reliability 28. Use of common unit of measurement and common format of reporting promotes; (a) Comparability (b) Understandability (c) Relevance (d) Reliability 29. To control the cost of production and distribution is the main field of (a) Financial Accounting (b) Cost Accounting (c) Auditing (d) None of these 30.The pioneer of accounting is: (a) Arthur field house (b) Giltman (c) William Pickles (d) Lucas Pacioli 31. Which of the following transactions will be entered in the books of Mr. X, a cloth merchant? (a) He receives a shirt as a gift on his birthday (b) He buys a shirt for his son (c) He sells cloth to one of his customers (d) None of the above 32The main objective of accounting is to see concern (a) Financial position of the concern (b) Position of the cash book (c) Position of purchases (d) Position of sales 33. Qualitative characteristics of Accounting Information are : (a) Reliability (b) Relevance (c) Understandable (d) All of the above 34. Accounting cycle includes: (a) Recording (b) Classification (c) Summarizing (d) All of the above

35. Which of the following is not a subfield of accounting? (a) Management accounting. (b) Cost accounting. (c) Financial accounting. (d) Book-keeping. 36. All of the following are functions of accounting except (a) Decision making. (b) Measurement. (c) Forecasting. (d) Ledger posting.

Assertion-Reason Type Questions 37. Statement-I “Accountancy starts where book-keeping ends.” Statement-II “Accountancy refers to the entire body of the theory and practice of Accounting.” (A) Both statements are true and Statement-II is the correct explanation of statement-I (B) Both statements are true but statement-II is not the correct explanation of statement-I (C) Statement-I is true, but statement-II is false (D) Statement-II is true, but statement-I is false. 38. Statement-I “Book-Keeping is the language of business.” Statement-II “Book-Keeping is an Art or Science.” (A) Both statements are true and Statement-II is the correct explanation of statement-I (B) Both statements are true but statement-II is not the correct explanation of statement-I (C) Statement-I is true, but statement-II is false (D) Statement-II is true, but statement-I is false. 39. Statement-I “Assets are future economic benefits, the rights which are owned or controlled by an organization or individuals.” Statement-II “Assets are valuable resources owned by a business which were acquired at a measurable money cost.” (A) Both statements are true and Statement-II is the correct explanation of statement-I (B) Both statements are true but statement-II is not the correct explanation of statement-I (C) Statement-I is true, but statement-II is false (D) Statement-II is true, but statement-I is false.

40. Statement-I “Book-Keeping is primary stage.” Statement-II “Accounting is secondary stage Accounting starts where bookkeeping ends.” (A) Both statements are true and Statement-II is the correct explanation of statement-I (B) Both statements are true but statement-II is not the correct explanation of statement-I (C) Statement-I is true, but statement-II is false (D) Statement-II is true, but statement-I is false.

41. Statement-I “Accountant is not required to possess analytical skill.” Statement-II “Book-keeper is not required to possess analytical skill.” (A) Both statements are true and Statement-II is the correct explanation of statement-I (B) Both statements are true but statement-II is not the correct explanation of statement-I (C) Statement-I is true, but statement-II is false (D) Statement-II is true, but statement-I is false. 42. Assertion (A): Accounting may lead to window dressing. Reason (R): Accounting is confined to monetary transactions only. (a) Both Assertion (A) and Reason (R) are True and Reason (R) is the correct explanation of Assertion (A). (b) Both Assertion (A) and Reason (R) are True and Reason (R) is not the correct explanation of Assertion (A). (c) Assertion (A) is True but Reason (R) is False. (d) Assertion (A) is False but Reason (R) is True. 43.Assertion (A): Accounting information refers to only events which are concerned with business firm. Reason (R): Accounting information is presented in financial statements. (a) Both Assertion (A) and Reason (R) are True and Reason (R) is the correct explanation of Assertion (A). (b) Both Assertion (A) and Reason (R) are True and Reason (R) is not the correct explanation of Assertion (A). (c) Assertion (A) is True but Reason (R) is False. (d) Assertion (A) is False but Reason (R) is True. 44. Assertion (A): Accounting information refers to only events which are concerned with business firm. Reason (R): Accounting information is presented in financial statements. (a) Both Assertion and Reason are correct and Reason is the correct explanation for Assertion

(b)Both Assertion and Reason are correct but Reason is not the correct explanation for Assertion (c) Assertion is correct but Reason is incorrect (d) Both Assertion and Reason are incorrect 44.Case Study Only those transactions and events are recorded in accounting which are of a financial character. There are so many transactions in the business which are very important for business but which cannot be measured and expressed in terms of money and hence such transactions will not be recorded. For example, the quarrel between the Production Manager and the Sales Manager, resignation by an able and experienced manager, strike by employees and starting of a new business by the other competitor etc. Though these events affect the earnings of the business adversely but as no one can measure the effect of such events in terms of money, these will not be recorded in the books of the business 1. What type of transactions are recorded in accounting? (a) Only Financial transactions are recorded (b) Financial and non-financial transactions (c) All types of transactions are recorded. (d) Accounting of all of the above 2. Which of the following are not recorded in accounting? (a) Quarrel between production manager and sales manager (b) Establishment of all most same business (c) Resignation by cashier (d) All of the above 3. What type of work is performed by accountant? (a) Analytical nature (b) Order type work (c) Understanding work (d) Work of own choice

Chapter 2 – Basic Accounting Terms – 1.Long term assets without any physical existence but, possessing a value are called (a) Intangible assets (b) Fixed assets (c) Current assets (d) Investments 2. The assets that can be easily converted into cash within a short period, i.e., 1 year or less are known as

(a) Current assets (b) Fixed assets (c) Intangible assets (d) Investments. 3. Copyrights, Patents and Trademarks are examples of (a) Current assets (b) Fixed assets (c) Intangible assets (d) Investments 4. The debts which are to be repaid within a short period (a year or less) are referred to as, (a) Current Liabilities (b) Fixed liabilities (c) Contingent liabilities (d)All the above 5. Gross profit is (a) Cost of goods sold + Opening stock (b) Sales – cost of goods sold (c) Sales – Purchases (d)Net profit – expenses 6. Net profit is calculated in which of the following account? (a) Profit and loss account (b) Balance sheet (c) Trial balance (d) Trading account. 7. Which of this best explains fixed assets? (a) Are bought to be used in the business (b) Are expensive items bought for the business (c) Are items which will not wear out quickly (d) Are of long life and are not purchased specifically for resale 8. Assets are: (a) Non-current Assets (b) Current Assets (c) Fictitious Assets (d) All of the above 9. Liabilities are: (a) Fixed Liabilities

(b) Current Liabilities (c) Contingent Liabilities (d) All of the above 10. Capitals are (a) Internal liability (b) External liability (c) Internal as well as external liability (d) None of the above 11. Goods includes: (a) Purchase of all the commodities (b) Purchase of all the Assets (c) Purchase of those commodities which are purchased for re-sale purpose (d) Purchase of liquid commodities only 12. A person who owes money to the firm is called a: (a) Creditor (b) Debtor (c) Proprietor (d) None of these 13. A person to whom money is owned by the firm is called a: (a) Creditor (b) Debtor (c) Employee (d) None of the above 14. Live Stock includes: (a) Plant and Machinery (b) Animals (c) Stock (d) Life Insurance Policy 15. Dead Stock includes: (a) Land and Building (b) Debtors (c) Creditors (d) Investments 16. Debentures are: (a) Short-term Liability (b) Contingent Liability (c) Long-term Liability

(d) Liquid Liability 17. Bank Loan is (a) Current Liability (b) Current Asset (c) Liquid Asset (d) None of the above 18 Identify the business transactions: (a) Economic Activity (b) Non-banking Activity (c) Change in financial position of business (d) Neither cash or credit transaction. 19. Which of the following is not a fixed asset (a) Building (b) Plant and Machinery (c) Goodwill (d) Balance with Bank. 20. Fixed assets are: (a) Cash (b) Debtors (c) Vehicle (e) Rent 21. Current assets are: (a) Machinery (b) Furniture (c) Investments (d) Closing stock 22. Fictitious assets are: (a) Bills Receivable (b) Motor Car (c) Preliminary Expenses (d) Debtors 23. Tangible assets are: (a) Stock (b) Discount (c) Cash (d) Land and building

24. Intangible assets are: (a) Loss (b) Goodwill (c) Profits (d) Cash at Bank 25. Fixed liabilities are: (a) Creditors (b) Bills Payable (c) Bank overdraft (d) Debentures 26. The sum of Liabilities and Capital is(a) Expense (b) Income (c) Drawings (d) Assets. 27.The amount drawn by businessmen for his personal use is(a) Capital (b) Drawing (c) Expenditure (d) Loss.

28.Which of the following is a capital expenditure (a) Wages (b) Wages paid for building construction (c) Repair expense of building (d) Advertisement Expense.

30.Amount received or receivable against sale of goods is: (a) Revenue Receipt (b) Capital Receipt (c) Both Revenue Receipt and capital receipt. (d) None of these 31.A liability arises due to: (a) Cash transaction (b) Credit transaction (c) Both cash as well as credit transaction. (d) None of these

32.Amount invested by the proprietor in a business is called: (a) Cash (b) Capital (c) Revenue. (d) Loan. 33.Amount paid or payable against purchase of goods is: (a) Revenue Expenditure (b) Capital Expenditure (c) Both Revenue Expenditure and capital Expenditure. (d) None of these. 34.Cash discount is: (a) Which is allowed at the time of making payment (b) Allowed at the time of sale of goods (c) Received at the time of making payment and purchase of goods. (d) Received at the time of purchase of goods. 35.Which of the following is Revenue? (a) Purchase (b) Purchase Returns (c) Sales. (d) Salary Payable. 36.The nature of capital is: (a) an asset. (b) a liability (c) an income (d) an expense. 37. The nature of accrued income is: (a) Revenue (b) Expense (c) Liability (d) Asset. 38. In simple words, the occurrence of something is called a: (a) Transaction (b) sale (c) Event (d) Purchase 39.Purchase refers to the buying of:

(a) Stationery for office use. (b) Assets for the factory. (c) Goods for resale. (d) Investment. 40.Case Study Mr. Sunrise started a business for buying and selling of stationery with ` 5,00,000 as an initial investment. Of which he paid `1,00,000 for furniture, ` 2,00,000 for buying stationery items. He employed a sales person and clerk. At the end of the month he paid ` 5,000 as their salaries. Out of the stationery bought he sold some stationery for `1,50,000 for cash and some other stationery for `1,00,000 on credit basis to Mr.Ravi. Subsequently, he bought stationery items of `1,50,000 from Mr. Peace. In the first week of next month there was a fire accident and he lost ` 30,000 worth of stationery. A part of the machinery, which cost ` 40,000, was sold for ` 45,000. From the above, answer the following: 1. What is the amount of capital with which Mr. Sunrise started business. 2. What are the fixed assets he bought? 3. What is the value of the goods purchased? 4. Who is the creditor and state the amount payable to him? 5. What are the expenses? 6. What is the gain he earned? 7. What is the loss he incurred? 8. Who is the debtor? What is the amount receivable from him? 9. What is the total amount of expenses and losses incurred? Matching Questions 41. Part - A (i) Fixed Asset is (ii) Floating Asset is (iii) Current Liability is (iv) Capital Expenditure is (v) Fixed Liability is

Part - B (a) Long-term loan (b) Creditors (c) Building Construction Expenses (d) Cash and Bank Balance (e) Land and Building

42. Part – A (i) Revenue expenditure is (ii) Live Stock is (iii) Allowed at the time of sales of goods (iv) Allowed at the time of receipt of payment (v) Dead Stock includes 43. Part-A (i) Bank Loan is (ii) Debentures are (iii) A person to whom money is owned by the firm is called a (iv) A person who owes money to the firm is called a (v) Drawings is treated.

Part - B (a) Land and Building (b) Cash Discount (c) Horses (d) Trade Discount (e) Wages of Workers Part - B (a) Creditor (b) Debtor (c) Amount withdraw for personal use (d) Long-term liability (e) Current liability

Assertion-Reason Type Questions 44. Assertion (A): Repairs of Rs. 10,000 incurred on purchase of second-hand machinery is recorded as revenue expenditure. Reason (R): Capital expenditure increases the earning capacity of the business. Alternatives: (a) Both Assertion (A) and Reason (R) are True and Reason (R) is the correct explanation of Assertion (A). (b) Both Assertion (A) and Reason (R) are True and Reason (R) is not the correct explanation of Assertion (A). (c) Assertion (A) is True but Reason (R) is False. (d) Assertion (A) is False but Reason (R) is True. 45. Assertion (A): Capital expenditure is incurred for the purpose of acquiring fixed asset. Reason (R): Capital expenditure item is shown in the asset side of the Balance Sheet. (a) Both Assertion (A) and Reason (R) are True and Reason (R) is the correct explanation of Assertion (A). (b) Both Assertion (A) and Reason (R) are True and Reason (R) is not the correct explanation of Assertion (A). (c) Assertion (A) is True but Reason (R) is False. (d) Assertion (A) is False but Reason (R) is True.

Chapter 3 – Theory base of Accounting 1.If one aspect of a transaction is not recorded, which accounting concept is NOT followed? (a) Revenue Recognition concept (b) Cost concept (c) Dual Aspect concept (d) Prudence concept 2. A business enterprise will not be sold or liquidated in near future- Which accounting concept reflects this statement? (a) Business Entity Concept (b) On Going Concern (c) Consistency (d) None of the above 3. ' Closing stock is valued at Cost Price or Market Price whichever is lower- Identify the concept applied

here. (a) Consistency Principle (b) Prudence Concept (c) Money Measurement Principle (d) Cost concept 4. Recognition of expenses in the same period as associated revenues is called ________ concept. (a) Revenue Realisation (b) Matching (c) Objectivity (d) Consistency 5. If advanced is received against sale of goods, the advanced received is recorded as " Advance Against Sale' and not Sales. Which accounting concept requires so? (a) Revenue Recognition concept (b) Dual Aspect concept (c) Money measurement concept (d) Prudence concept 6. Generally the duration of an accounting period is of(a) 6 months (b) 3 months (c) 12 months (d) 1 month. 7. In India, the accounting standard board was set up in the year(a) 1972 (b) 1977 (c) 1956 (d) 1932. 8. The basic accounting postulates are denoted by – (a) Concepts (b) Book – keeping (c) Accounting standards (d) None of these. 9. Meaning of credibility of going concern is: (a) Closing of business (b) Opening of business (c) Continuing of business (d) None of these.

10. IFRS are based on: (a) Fair Value (b) Historical cost (c) Both historical and fair value (d) None of these. 10. IFRS are: (a) Principle based accounting standard (b) Rule based accounting standard (c) Partially rule and partially principle (d) None of these. 11. A concept that a business enterprise will not be sold or liquidated in the near future is known as: (a) Going concern (b) Economic entity (c) Monetary unit (d) None of the above

12.During the lifetime of an entity accounting produce financial statements in accordance with which basic accounting concept: (a) Conservation (b) Matching (c) Accounting period (d) None of the above. 13. IASB (International Accounting Standards Board) upon coming into existence has adopted: (a) All IAS and SIC (Standing Interpretation Boar (b) Some IAS and SIC (c) None of the options (d) None of the IAS and SIC. 14. Recognition of expenses in the same period as associated revenues is called ………………. concept. (a) Accrual (b) Matching (c) Accounting period (d) Consistency 15. The accounting concept that refers to the tendency of accountants to resolve uncertainty and doubt in favor of understating assets and revenues and overstating liabilities and expenses is known as ………………….

(a) Accrual (b) Matching (c) Accounting period (d) Consistency. 16. According to which accounting principle personal expenses of proprietor are

recorded in drawings account? (a) Money Measurement Principle (b) Matching (c) Business Entity concept (d) Prudence.

17. Under which accounting principle quality of manpower is not recorded in the books of accounts? (a) Money Measurement Principle (b) Matching (c) Business Entity concept (d) Prudence.

18.Which accounting principle requires that life of a business be broken into smaller parts? (a) Accrual (b) Matching (c) Accounting period (d) Consistency 19.Under which accounting concept fixed assets are recorded at cost without considering the market price (whether low or high)? (a) Historical cost concept (b) Prudence (c) Accounting period (d) Consistency. 20.Single Entry system ignores ______ of accounting. (a) Historical cost concept (b) Revenue concept (c) Matching concept (d) Dual Aspect. 21. Closing stock is valued at lower of cost or market price. Which concept of accounting is applied here? (a) Historical cost concept (b) Conservatism (c) Matching concept (d) Dual Aspect.

22. According to Business Entity concept (a) transactions between the business and its owner are recorded from the business point of view (b) Transactions between the business and its owner are recoded considering it single entity (c) Transactions between the business and its owner are not recoded (d) None of these 23. Full form of GAAP (a) Generally Accepted Accounting Principle (b) Generally Accounting Accepted Principle (c) Journal Accepted Accounting Principle. (d) Generally Accepted Accounting Prudence 24.According to the money measurement concept (a)All transactions and events are recorded (b)All transactions and events which can be estimated in money terms are recorded I the books of accounts (c)All the transactions and events which can be measured in money terms are recorded in the books of accounts (d)None of the above 25.According to the cost concept (a)Assets are recorded at the value paid for acquiring them (b)Assets are recorded by estimating the market value at the time of purchase (c)Assets are recorded at the lower of cost or market value (d)None of the above 26.According to the going concern concept (a)Assets are recorded at the cost and are depreciated over their useful life (b)Assets are valued at their market value at the year-end and are recorded in the books of accounts (c)Assets are valued at their market value, recorded in the books and depreciation is charged on the market value (d)None of the above 27.According to the accrual concept (a)Transactions and events are recorded in the books at the time of their settlement in cash (b)Transactions and events are recorded in the books at the time when they are entered into (c)Transactions and events may be recorded either at the same time of the settlement or when they are entered into (d)None of the above 28.According to the convention of consistency

(a)Accounting policies and practices once adopted should be consistently followed (b)Accounting policies and practices once adopted maybe changed as per the management’s decision (c)Accounting policies and practices once adopted cannot be changed under any circumstances (d)None of the above 29.According to the going concern concept a business is viewed as having (a)a limited life (b)a very long life (c)an indefinite life (d)None of these 30.According to which of the following concepts, even the proprietor of a business is treated as creditor to the extend of his capital (a)Money measurement concept (b)Dual aspect concept (c)Cost concept (d)Business entity concept 31.According to which of the following concepts, in determining the net income from business, all costs which are applicable to the revenue of the period should be charged against that revenue? (a)Matching concept (b)Money measurement concept (c)Cost concept (d)Dual aspect concept

32. During the lifetime of an entity, accounting produces financial statements in accordance with which of the following concept (a)Matching (b)Conservatism (c)Accounting period (d)Cost 33.X ltd follows the return down value method of depreciating machinery year after year due to (a)Comparability (b)Convenience (c)Consistency (d)All of these 34.The convention of conservation takes into account (a)All the prospective profits and prospective losses (b)All the prospective profits and leaves out prospective losses

(c)All the prospective losses but leaves out prospective profits (d)None of the above 35.Ind-AS are (a)Rule based accounting standards (b)Principle based accounting standards (c)Partially rule based and Partially principle-based accounting standards (d)None of above 36.Assets (Except securities) may be valued under Ind-AS on (a)Historical cost (b)Fair value (c)Both historical cost and fair value (d)None of these. 37. Rent outstanding is added to Rent A/c in accordance with which of the following concept (a)Matching (b)Conservatism (c)Accounting period (d)Cost 38. For every debit there is a corresponding credit (a)Matching concept (b)Money measurement concept (c)Cost concept (d)Dual aspect concept 39. A machinery purchased for Rs.5000, transportation charges Rs.1000 and installation cost Rs.2000. The amount of transaction recorded is Rs.8000.

(a)Matching (b)Conservatism (c)Accounting period (d)Cost 40. Assets and Liabilities shown in Balance sheet in accordance with which of the following concept (a)Matching (b) Full disclosure concept (c) Revenue recognition concept (d)Dual aspect concept 41. ABC Ltd. sold goods to XYZ Ltd on credit assuming that they can realize the amount in future. Which accounting concept is applicable?

(a) On going concept (b) Full disclosure concept

(c) Revenue recognition concept (d)Dual aspect concept. 42. Accounting information should be free from bias in accordance with which of the following concept (a) On going concept (b) Objectivity concept. (c) Revenue recognition concept (d)Dual aspect concept. 43. Account books should not be overloaded with irrelevant facts (a)Matching (b) Materiality concept (c) Revenue recognition concept (d) Objectivity concept. 44. According to which of the following concept, Profit = Revenue – Expenses (a) Matching concept (b) Materiality concept (c) Revenue recognition concept (d) Objectivity concept. 45. According to which of the following concept, Sales is recorded when the title of goods passes from the seller to the buyer (cash or credit).

(a) On going concept (b) Objectivity concept. (c) Revenue recognition concept (d)Dual aspect concept. 46. There must be a source document for every transaction, in accordance with which of the following concept (a) On going concept (b) Materiality concept (c) Revenue recognition concept (d) Objectivity concept. 47. 100 Kg rice @ Rs.20 purchased by a grocery shop, recorded it as Rs.2000 as per: (a)Matching concept (b)Money measurement concept (c)Cost concept (d)Dual aspect concept 48. Profit and Loss account and Balance sheet is prepared at the end of every year (a)Matching

(b)Conservatism (c)Accounting period (d)Cost 49. Contingent liabilities are shown as a footnote in Balance Sheet under which concept (a) On going concept (b) Full disclosure concept (c) Revenue recognition concept (d)Dual aspect concept. 50. According to which of the following concept, Stock of stationery items are not treated as asset, but it is an expense.

(a) On going concept (b) Materiality concept (c) Revenue recognition concept (d) Objectivity concept.

Assertion-Reason Type Questions 51.Assertion (A): Personal transactions of the owners of the business are not recorded in the books. Reasoning (R): According to the business entity concept, each business enterprise is considered as an accounting unit separate from owners. (a) Both Assertion (A) and Reason (R) are True and Reason (R) is the correct explanation of Assertion (A). (b) Both Assertion (A) and Reason (R) are True and Reason (R) is not the correct explanation of Assertion (A). (c) Assertion (A) is True but Reason (R) is False. (d) Assertion (A) is False but Reason (R) is True.

Chapter 4 & 5 – Basis of Accounting &Accounting Equation. 1. Under the Cash Basis of Accounting, Expenses are recorded (a) On Payment (b) On being Incurred (c) either (a) or (b) (d) None of these. 2. Under the Accrual Basis of Accounting, Expenses are recorded (a) On Payment

(b) On being Incurred (c) either (a) or (b) (d) None of these. 3.Accrual Basis of Accounting (a) does not give a true and fair view of profit and financial position (b) gives a true and fair view of profit and financial position (c) may or may not give a true and fair view of profit and financial position (d) None of these. 4.Accrual Basis of Accounting recognizes (a) Outstanding and Pre-paid Expenses (b)Accrued Income and Incomes Received in Advances (c) Both (a) and (b) (d) None of these. 5. Under Accrual Basis of Accounting recognizes (a) Both cash and credit transactions are recorded (b) Only cash transactions are recorded (c) Only Credit transactions are recorded (d) None of these. 6. The Mathematical Expression defining the comparative relationship between Assets and Liabilities of any person, institution or Business concern is called(a) Accounting (b) Accounting Equation (c) Book – keeping (d) None of these. 7. Liabilities and Assets amount to Rs. 50,000 and Rs. 7,800 respectively. The difference Amount shall represent(a) Creditors (b) Debentures (c) Profit (d) Capital. 8. Which of the following equation’s correct? (a) Assets = Liabilities – Capital (b) Assets = Capital – Liabilities (c) Assets = Liabilities + Capital (d) Assets = External Equities 9. Which of the following is correct? (a) Profit/Loss = Closing Capital + Additional Capital – Drawings – Opening Capital (b) Profit/Loss = Closing Capital-Drawings-Additional Capital – Opening Capital

(c) Profit/Loss = Opening Capital + Drawings made – Additional Capital – Closing Capital (d) Profit/Lose = Closing Capital + Drawings made – Additional Capital – Opening Capital 10. The liabilities of a firm are Rs. 60,000 and the capital of the proprietor is Rs. 40,000. The total assets are: (a) 60,000 (b) 1,00,000 (c) 20,000 (d) 40,000. 11. The Mathematical Expression defining the comparative relationship between Assets and Liabilities of any person, institution or Business concern is called(a) Accounting (b) Accounting Equation (c) Book – keeping (d) None of these 12. On January 1st, 2009 an entity's balance sheet showed total assets of Rs. 750 and liabilities of Rs. 250. Owners' equity at January 1st was? a) 750 (b)1000 (c) 500 (d) 250. 13. If the assets of a business are Rs. 100,000 and equity is Rs. 20,000, the value of liability will

be? (a) Rs. 100,000 (b) Rs. 80,000 (c) Rs. 120,000 (d) Rs 20,000 14. The accounting equation should remain in balance because every transaction affects how many accounts? (a) Only one (b) Only two (c) Two or more (d) All of given options 15. Which of the following is not a correct form of the Accounting Equation? (a) Assets = Claims (b) Assets = Liabilities + Owner Equity (c) Assets – Liabilities = Owner’s Equity (d) Assets + Owner’s Equity = Liabilities

16. Find out value of account receivable from following Cash Rs. 48,000 account payable Rs. 33,000 office equipment Rs. 21,000 owner equity Rs. 77,000? (a) Rs. 21,000 (b) Rs. 41,000 (c) Rs. 15,000 (d) Rs. 110,000

17. During a reporting period, a company’s assets increase by Rs. 80,000,000. Liabilities decrease by Rs. 20,000,000. Equity must therefore? (a) Decrease by Rs. 100,000,000 (b) Increase by Rs. 100,000,000 (c) Decrease by Rs. 60,00,000 (d) Increase by Rs. 60,000,000 18. Which one of the following equations correctly expresses the relationship between assets (A), liabilities (L), revenues (R), expenses (E) and capital (C)? (a) A = L + R + E + C (b) A = C + L + (R-E) (c) A = C - (R - E) + L (d) A = (L - C) + (R - E) 19. The liabilities of a business are Rs. 30,000; the capital of the proprietor is Rs. 70,000. The total assets are? (a) Rs.70,000 (b) Rs. 30,000 (c) Rs.40,000 (d) None 20. Which of the following account is affected from the drawings of cash in sole-proprietorship business? (a) Shareholder account (b) Capital account (c) Liability account (d) Expense account 21. Mr. “A” borrowed money from bank; this transaction involves which one of the following accounts? (a) Cash & Bank Loan (b) Bank & Debtors (c) Drawing & Cash (d) Cash & Bank 22. Mr. A provided the following information from his books of accounts at the end of the

month. What is the amount of his capital?

(a) Rs. 200 (b) Rs. 900 (c) Rs. 1,200 (d) Rs. 1,300 23. Which of the following accounts will be used in equation, if the goods are sold on credit to

Mr. Mahmood? (a) Cash account and Owner’s equity (b) Account Receivable and Owner’s equity (c) Cash and Account Receivable (d) Account Payable and Owner’s Equity 24. The favorable balance of profit and loss account should be? (a) Added in liabilities (b) Subtracted from current assets (c) Subtracted from liabilities (d) Added in capital 25. Revenue of the business includes?

(a) Cash sales only (b) Credit sales only (c) Credit purchases only (d) Both cash sales and credit sales 26. Which of the following transactions would have no impact on stockholders' equity?

(a) Purchase of land on credit (b) Dividends to stockholders (c) Net loss (d) Investment in cash by stockholders 27.Accounting Equation represents (a) Resource is allocated at Cost Price (b) Owner’s Gives money for business (c) Resource in the business is equal to source of business (d) Resource in the business is not equal to the source of business

28. The accounting equation should remain in balance because every transaction affects how many accounts?

(a) Only one (b) Only two (c) Two or more (d) All of given options 29.Decrease in one liability may lead to

(a) Decrease in an asset (b) Increase in another liability (c) Either (a) or (b) (d) None of the given options 30. An increase in one asset is accompanied by (a) Decrease in an asset (b) Increase in another liability (c) Increase in capital (d) All of these

Chapter 6 – Accounting Procedure, Rules of debit and Credit. 1 The following account has a debit balance (a) Creditor’s A/c (b) Capital A/c (c) Building A/c (d) Loan A/c 2.Debit means (a) Increase in asset (b) Increase in Liability (c) Increase in the proprietor’s equity (d) Decrease in asset 3. Credit means (a) Increase in asset (b) Increase in Liability (c) decrease in the proprietor’s equity (d) Decrease in liability 4. Prepaid salary account is a. (a) Personal, (b) Real (c) Nominal (d) None of the above

5.Bill payable account is a. (a) Personal, (b) Real (c) Nominal (d) None of the above 6. Rent account is a. (a) Personal, (b) Real (c) Nominal (d) None of the above 7 Proprietor’s account is a. (a) Personal, (b) Real (c) Nominal (d) None of the above 8. Patents account is a. (a) Personal, (b) Real (c) Nominal (d) None of the above 9. Salaries is a. (a) revenue(R) (b) expense (E) (c) asset (A) (d) liability (L) 10. Equipment is a. (a) revenue(R), (b) expense (E), (c) asset (A), (d) liability (L), 11 Accounts payable is a. (a) revenue(R), (b) expense (E), (c) asset (A), (d) liability (L) 12. Membership fees earned is a. (a) revenue(R)

(b) expense (E) (c) asset (A), (d) liability (L) 13 Stock is a (a) revenue(R) (b) expense (E), (c) asset (A), (d) liability (L) 14. Accounts receivable is a. (a) revenue(R) (b) expense (E) (c) asset (A) (d) liability (L) 15 Building is a. (a) revenue(R) (b) expense (E) (c) asset (A) (d) liability (L) 16. Profits. (a) revenue(R) (b) expense (E) (c) asset (A) (d) owner’s capital 17. A sale of goods to Ram for cash should be debited to: (a) Ram (b) Cash (c) Sales (d) Capital 18. A withdrawal of cash from business by the proprietor should be credited to: (a) Drawing Account (b) Capital Account (c) Cash Account (d) Purchase Account 19.Nominal Accounts are related to (a) Assets and Liabilities (b) Expenses and Revenue (c) Debtors and Creditors

(d) None of those. 20. Goodwill account is a (a) Personal Account (b) Real Account (c) Nominal Account (d) None of these. 21.Debits (a) increase both assets and liabilities. (b) decrease both assets and liabilities. (c) increase assets and decrease liabilities. (d) decrease assets and increase liabilities. 22. A debit is NOT the normal balance for which account listed below? (a) Revenue (b) Cash (c) Accounts Receivable (d) Dividends 23. Which of the following describes the classification and normal balance of the Unearned Rent Revenue account? (a) Asset, debit (b) Liability, credit (c) Revenues, credit (d) Expense, debit

Assertion-Reason Type Questions 24.Assertion (A): The rules for Debit and Credit for liability and capital are the same. Reason (R): As per Business Entity Concept, business is separate & distinct from its owner. Alternatives: (a) Both Assertion (A) and Reason (R) are True and Reason (R) is the correct explanation of Assertion (A). (b) Both Assertion (A) and Reason (R) are True and Reason (R) is not the correct explanation of Assertion (A). (c) Assertion (A) is True but Reason (R) is False. (d) Assertion (A) is False but Reason (R) is True. 25. Assertion (A): Purchase of Asset is always debited. Reason (R): Liabilities always have a credit balance. Alternatives: (a) Both Assertion (A) and Reason (R) are True and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are True and Reason (R) is not the correct explanation of Assertion (A). (c) Assertion (A) is True but Reason (R) is False. (d) Assertion (A) is False but Reason (R) is True. 26. Match the Following Column A

Column B

1. Building

(a) Debit

2. Salary

(b) Credit

3. Left side

(c) Asset

4. Right side

(d) Expense

5. Vouchers

(e) Written document.

Chapter 7 – Source Documents. 1.When a trader sells goods on credit, he prepares; (a) Cash memo (b) invoice (c) receipts (d) debit notes 2.Name the source of document sends to supplier when a business return goods; (a)debit note (b)credit note (c) invoice (d) cash memo 3 The document which is prepare for the purpose of recording of transaction called: (a) Source of documents (b) voucher (c) journal (d) ledger. 4 A source document is :

(a) The origin of the information that is recorded into the accounting books (b) The origin of the information that is taken from the accounting book (c) Not the origin of information that is recorded into the accounting books (d) Not the origin of information that is taken from the accounting books 5 Credit notes are issued when...: (a) The seller delivers goods to the purchaser (b) Goods are returned to the seller by the purchaser (c) There is not enough money in the bank (d) None of these. 6.Who gets the document? (a) The business issuing the document (b) The business receiving the document (c) Usually both businesses involved in the transaction (d) None of these. 7. In accounting, pieces of paper that prove that a transaction occurred are called __ (a) Ledger (b)Journal (c) Balance sheet (d) Source document. 8. Cash memo is prepared when goods are sold (a) Ledger (b)Journal (c) Balance sheet (d) Source document.

9.Cash memo is prepared when goods are sold (a) On credit (b)On cash (c)Both A and B (d)None of these

10.Cash memo is source voucher for purchase of goods (a) For cash purchases (b)For cash sales (c)for credit purchase (d)for credit sales

11.Invoice is a source voucher for seller of goods (a) for cash sales (b)for credit purchases (c)for credit sales (d) for cash purchases

12.Invoice is a source voucher for purchaser of goods (a) For cash purchases (b)for cash sales (c)for credit sales (d)for credit purchses

13.Accounting voucher is prepared from (a)Source voucher (b)Journal entry (c)Both A and B (d)None of these 14.If purchaser of goods returns them, he will prepare (a) Credit note (b)Debit note (c)Both A and B (d)None of these 15.If seller receives back the goods sold, he will prepare (a) Credit note (b)Debit note (c)Both A and B (d)None of these 16.Voucher is prepared for (a) Cash and credit purchases (b)Cash and credit sales (c)Cash received and paid (d)All of these

17.Cash memo is (a) A source voucher (b)An accounting voucher (c)Neither A or B (d)both A and B 18.Invoice is a source voucher for (a) Cash purchases (b)Credit purchases (c)Neither A or B (d)Both A and B 19.Books of account are return on the basis of (a) Source document (b)Accounting vouchers (c)Both A and B

(d)None of these 20. Credit note is prepared (a) When credit is given to the account (b)When debit is given to the account (c)Both A and B (d)None of the above 21. When goods are sold on credit the seller prepares (a) Cash memo (b) Invoice (c)Accounting voucher (d)None of these 22. When goods are prepared against cash, purchases will get (a) Cash memo (b) Invoice (c) Accounting voucher (d) None of these 23. Transfer voucher are prepared to record (a) Cash transaction (b)non-cash transaction (c) a and b (d)none of these 24. Credit purchase of furniture is recorded through (a) Transfer voucher (b) Cash voucher (c) Debit voucher (d)Credit voucher

Chapter 8 & 9 – Journal and Ledger. 1. The process of transferring the debit and credit items from a Journal to their respective accounts in the ledger is termed as (a) posting (b) purchase (c) balancing of an account (d) arithmetically accuracy test 2. The technique of finding the net balance of an account after considering the totals of both debits and credits appearing in the account is known as (a) posting (b) purchase

(c) balancing of an account (d) arithmetically accuracy test. 3. Journal and ledger records transactions in (a) a chronological order and analytical order respectively. (b) an analytical order and chronological order respectively. (c) a chronological order only (d) an analytical order only. 4. Ledger book is popularly known as (a) secondary book of accounts (b) principal book of accounts (c) subsidiary book of accounts (d) none of the above 5.At the end of the accounting year all the nominal accounts of the ledger book are (a) balanced but not transferred to profit and loss account (b) not balanced and also the balance is not transferred to the profit and loss account (c) balanced and the balance is transferred to the balance sheet (d) not balanced and their balance is transferred to the profit and loss account. 6. If we take goods for own use we should (a) Debit Drawings Account, Credit Purchases Account (b) Debit Drawings Account: Credit Stock Account (c) Debit Sales Account: Credit Stock Account (d) Debit Purchases Account: Credit Drawings Account. 7. The first book of original entry is(a) Journal (b) Ledger (c) Trial Balance (d)None of these. 8. Income tax is treated as(a) Business Expense (b) Direct Expense (c) Personal Expense (d) Indirect Expense. 9.Balancing of account means (a) Total of debit side (b) Total of credit side (c) Difference in total of debit & credit (d) None of these.

10.Which of the following statement about an account is true? (a). The right side of an account is the debit, or increase side. (b) An account is an individual accounting record of increases and decreases in specific assets, liability, and stockholders’ equity items. (c)There are separate accounts for specific assets and liabilities but only one account for stockholders’ equity items. (d) The left side of an account is the credit, or decrease, side. 11. Which of the following are part of the recording process? (a) Analyzing transactions (b) Entering Transactions in a journal (c) Posting journal entries (d) All of the above. 12. The right side of a t-account is (a) the balance of an account. (b) the debit side. (c) the credit side. (d) blank. 13. Powers Corporation received a cash advance of $500 from a customer. As a result of this event, (a) assets increased by $500 (Debited). (b) equity increased by $500 (Credited). (c) liabilities decreased by $500 (Debited). (d) Both assets and equity increased by $500 (Debited and Credited) 14. When a company performs a service but has not yet received payment, it (a) debits Service Revenue and credits Accounts Receivable. (b) debits Accounts Receivable and credits Service Revenue. (c) debits Service Revenue and credits Accounts Payable. (d) makes no entry until cash is received. 15. In which order does the Journal list transactions?

(a) Chronological (b) Decreasing (c) Increasing (d) Alphabetical. 16. All of the following are true regarding journal entries except? (a) Journal entries show the effects of transactions (b) Journal entries provide account balances (c) The debited account titles are listed first (d) Each journal entry should begin with a date.

17. Among these transactions, which transaction will have no impact on stockholders’ equity? (a) Net loss (b) Investment of cash by stockholders (c) Dividends to stockholders (d) Purchase of the land from the proceeds of bank loan. 18. Amount invested by the proprietor in the business should be credit to: (a) A/c payable (b) Capital (c) Cash (d) Drawing. 19. Transactions are first recorded in which book/account? (a) Book of Original Entry (b) T Accounts (c) Accounting Equation (d) Book of Final Entry. 20. Goods returned by customer will be debited to which account? (a) Purchases A/C (b) Return outward (c) Customer’s A/C (d) Return inward 21. Journal is also called a? (a) A day book (b) History book (c) Ledger book (d) An entry book

22. ________ A/c is credited and ____ A/c is debited in case wages are paid for construction of business premises (a) Cash, Wages (b) Cash, Premises (c) Premises, Cash (d) Wages, Cash. 23. Among these statements which one is incorrect regarding journal entry? (a) The debited account titles are listed first (b) Journal entries show the effects of transactions (c) Each journal entry should begin with a date (d) Journal entries provide account balances 24. The usual sequence of steps in the transaction recording process is

(a) analyze →journal →ledger . (b) journal →ledger →analyze. (c) ledger →journal →analyze. (d) journal →analyze →ledger 25.The final step in the recording process is to transfer the journal information to the (a)trial balance. (b)financial statements. (c)ledger. (d)file cabinets.

Assertion-Reason Type Questions 26 Assertion (A): Debt written off as bad, when recovered subsequently, is credited to Debtors account. Reason (R): Bad Debts recovered are credited as it is accounted as a gain. Alternatives: (a) Both Assertion (A) and Reason (R) are True and Reason (R) is the correct explanation of Assertion (A). (b) Both Assertion (A) and Reason (R) are True and Reason (R) is not the correct explanation of Assertion (A). (c) Assertion (A) is True but Reason (R) is False. (d) Assertion (A) is False but Reason (R) is True.

Chapter 10 & 11 – Specialpurpose book,Cash book and other books. 1. Cash purchase of goods is recorded in(a) Purchase book (b) Sales book (c) Cash – book (d) None of these. 2. Credit purchase of furniture shall be recorded in(a) Purchase book (b) Journal book

(c) Cash – book (d) None of these. 3. When a firm maintains a cash book, it need not maintain (a) Journal Proper (b) Purchases (journal) book (c) Sales (journal) book (d) Bank and cash account in the ledger 4. Double column cash book records (a) All transactions (b) Cash and bank transactions (c) Only cash transactions (d) Only credit transactions 5.Goods purchased on cash are recorded in the (a) Purchases (journal) book (b) Sales (journal) book (c) Cash book (d) Purchases return (journal) book 6.Cash book does not record transaction of: (a) Cash nature (b) Credit nature (c) Cash and credit nature (d) None of these

7.Total of these transactions is posted in purchase account: (a) Purchase of furniture (b) Cash and credit purchase (c) Purchases return (d) Purchase of stationery

8.The periodic total of sales return journal is posted to : (a) Sales account (b) Goods account (c) Purchases return account (d) Sales return account 9.Credit balance of bank account in cash book shows : (a) Overdraft

(b) Cash deposited in our bank (c) Cash withdrawn from bank (d) None of these 10.The periodic total of purchases return journal is posted to : (a) Purchase account (b) Profit and loss account (c) Purchase returns account (d) Furniture account 11.The debit note issued are used to prepare (a) Sales return book. (b) Purchase return book. (c) Sales book. (d) Purchases book. 12 An allowance of Rs. 50 was offered for an early payment of cash of Rs. 1,050. (a) Sales Book (b) Cash Book (c) Journal Proper (General Journal) (d) Purchase Book 13.A second hand motor car was purchased on credit from B Brothers for Rs. 10,000. (a) Journal Proper (General Journal) (b) Sales Book (c) Cash Book (d) Purchase Book 14.Goods were sold on credit basis to A Brothers for Rs. 1,000. (a) Cash Book (b) Journal Proper (General Journal) (c) Sales Book (d) Bills Receivable Book 15. Accounting for partial recovery from Mr. C of an amount of Rs. 2,000 earlier written off as bad debt. (a) Journal Proper (General Journal) (b) Sales Book (c) Purchase Book (d) Cash Book 16. Which one of the following affects cash book during a period? (a) Recording depreciation expense (b) Declaration of a cash dividend

(c) Write-off of an uncollectible account receivable (d) Payment of an accounts payable. 17. The transaction will be treated as a contra entry when? (a) Cash withdrew from bank for personal use (b) Check received from customer and deposited (c) Cash drew from bank for office use (d) None of Above. 18. Which one of the following is not correct for cash book?

(a) It is a dual book (b) It is journalized ledger (c) It records liabilities (d) Double Purpose Book. 19. A check received on 12th of December dated 25th December is considered as? (a) Bank (b) Cash (c) Liability (d) Revenue 20. Which of the following item is not included in the Cash Book? (a) Purchases of Rs. 10,000 (b) Sales of Rs.5,000 (c) Received cash for Salman Rs. 2,000 (d) Credit sales of Rs. 22,000.

Chapter 12 – Bank Reconciliation Statement. 1.When the balance as per Cash Book is the starting point, direct deposits by customers are: (a) added (b) subtracted; (c) not required to be adjusted (d) neither of the two 2. A Bank Reconciliation Statement is a (a) part of Cash Book; (b) part of Bank Account; (c) part of financial statements, (d) none of the above. 3. When balance as per Pass Book is the starting point, interest allowed by Bank is

(a) added (b) subtracted (c) not required to be adjusted. (d) None of the above. 4. A Bank Reconciliation Statement is prepared with the help of: (a) Bank statement and bank column of the Cash Book. (b) Bank statement and cash column of the Cash Book (c) Bank column of the Cash Book and cash column of the Cash Book (d) None of the above. 5. Debit balance as per Cash Book of ABC Enterprises as on 31.3.2006 is Rs. 1,500. Cheques deposited but not cleared amounts to Rs. 100 and Cheques issued but not presented of Rs. 150. The bank allowed interest amounting Rs. 50 and collected dividend Rs. 50 on behalf of ABC Enterprises. Balance as per pass book should be (a) 1,600. (b) 1,450. (c) 1,850. (d) 1,650. 6. The cash book showed an overdraft of Rs. 1,500 as cash at bank, but the pass book made up to the same date showed that cheques of Rs. 100,Rs. 50 and Rs. 125 respectively had not been presented for payments; and the cheque of Rs.400 paid into account had not been cleared. The balance as per the cash book will be (a) Rs. 1,100. (b) Rs. 2,175. (c) Rs. 1,625. (d) Rs. 1,375.

7. When drawing up a Bank Reconciliation Statement, if you start with a debit balance as per the Bank Statement, the unpresented cheques should be: (a) Added; (b) Deducted; (c) Not required to be adjusted. (d) None of the above. 8. A debit balance in the depositor’s Cash Book will be shown as: (a) a debit balance on the Bank Statement. (b) a credit balance on the Bank Statement. (c) an overdrawn balance on Bank Statement. (d) None of the above. 9. When preparing a Bank Reconciliation Statement, if you start with a debit balance as per the Cash Book, cheques issued but not presented within the period should be:

(a) Added; (b) Deducted; (c) not required to be adjusted (d) None of the above. 10. When the balance as per Pass Book is the starting point, direct payment by bank are: (a) added in the bank reconciliation statement (b) subtracted in the bank reconciliation statement (c) Not required to be adjusted in the bank reconciliation statement. (d) Neither of the above. 11. When balance as per Cash Book is the starting point, uncollected cheques are: (a) added in the bank reconciliation statement (b) subtracted in the bank reconciliation statement (c) ‘Not required to be adjusted in the bank reconciliation statement (d) neither of the above. 12. A Bank Reconciliation Statement is prepared to know the causes for the difference between: (a) the balances as per cash column of Cash Book and the Pass Book. (b) the balance as per bank column of Cash Book and the Pass Book. (c) the balance as per bank column of Cash Book and balances as per cash column of Cash Book (d) Neither of the above. 13. When the balance as per Pass Book is the starting point, uncollected cheques are: (a) added in the bank reconciliation statement (b) subtracted in the bank reconciliation statement (c) not required to be adjusted in the bank reconciliation statement. (d) neither of the above. 14. When balance as per Cash Book is the starting point, interest charged by Bank is: (a) added in the bank reconciliation statement (b) subtracted in the bank reconciliation statement (c) not required to be adjusted in the bank reconciliation statement (d) neither of the above. 15. Following are the salient features of bank reconciliation statement except: (a) Any undue delay in the clearance of cheques will be shown up by the reconciliation (b) Reconciliation statement will help in finding the person doing any fraud (c) Reconciliation is done by the bankers (d) It helps in finding out the actual position of the bank balance. 16. Match the following items from column A with column B

S. No. Column A 1. Debit Balance in the Cash Book means 2. A Bank Reconciliation is prepared by: 3. A Bank Statement is a copy of: 4. Credit Balance in the cash book means:

Column B (a) Account holders (b) Overdraft as per Pass Book (c) Credit balance as per Pass Book (d) A customers account in the Bank’s book.

Chapter 14 – Depreciation. 1.Obsolescence of a depreciable asset may be caused by I. Technological changes. II. Improvement in production method. III. Change in market demand for the product or service output. IV. Legal or other restrictions. (a) Only (I) above (b) Both (I) and (II) above (c) All (I), (II), (III) and (IV) above (d) Only (IV) above. 2. Which of the following statements is/are false? I. The term ‘depreciation’, ‘depletion’ and ‘amortization’ convey the same meaning. II. Provision for depreciation a/c is debited when provision for depreciation a/c is created. III. The main purpose of charging the profit and loss a/c with the amount of depreciation is to spread the cost of an asset over its useful life for the purpose of income determination. (a) Only (I) above (b) Only (II) above (c) Only (III) above (d) All (I) (II) and (III) above. 3. Amit Ltd. purchased a machine on 01.01.2003 for Rs 1,20,000. Installation expenses were Rs 10,000. Residual value after 5 years Rs 5,000. On 01.07.2003, expenses for repairs were incurred to the extent of Rs 2,000. Depreciation is provided under straight line method. Annual Depreciation = _____. (a) 13,000 (b) 17,000 (c) 21,000 (d) 25,000. 4. The number of production or similar units expected to be obtained from the use of an asset by an enterprise is called as (a) Unit life (b) Useful life (c) Production life (d) Expected life.

5. Which of the following is not true with regard to fixed assets? (a) They are acquired for using them in the conduct of business operations (b) They are not meant for resale to earn profit (c) They can easily be converted into cash (d) Depreciation at specified rates is to be charged on most of the fixed assets. 6. Original cost = Rs 1,26,000. Salvage value = 6,000. Useful Life = 6 years. Annual depreciation = (a) 21,000 (b) 20,000 (c) 15,000 (d) 14,000. 7. Original cost = Rs 1,26,000. Salvage value = 6,000. Depreciation for 2nd year @ 10% p.a. under WDV method = (a) 10,800 (b) 11,340 (c) 15,000 (d) 14,000. 8. Which of the following expenses is not included in the acquisition cost of a plant and equipment? (a) Cost of site preparation (b) Delivery and handling charges (c) Installation costs (d) Financing costs incurred subsequent to the period after plant and equipment is put to use. 9. For charging depreciation, on which of the following assets, the depletion method is adopted? (a) Plant & machinery (b) Land & building (c) Goodwill (d) Wasting assets like mines and quarries. 10. If a concern proposes to discontinue its business from March 2005 and decides to dispose off all its assets within a period of 4 months, the Balance Sheet as on March 31, 2005 should indicate the assets at their (a) Historical cost (b) Net realizable value (c) Cost less depreciation (d) Cost price or market value, whichever is lower. 11. In which of the following methods, is the cost of the asset written off in equal proportion, during its useful economic life?

(a) Straight line method (b) Written down value method (c) Units-of-production method (d) Sum-of-the-years’-digits method. 12. The portion of the acquisition cost of the asset, yet to be allocated is known as (a) Written down value (b) Accumulated value (c) Realizable value (d) Salvage value. 13. Consider the following information: I. Rate of depreciation under the written down method = 20%. II. Original cost of the asset = Rs.1,00,000. III. Residual value of the asset at the end of useful life = Rs.40,960. (i) The estimated useful life of the asset, in years, is (a) 4 (b) 5 (c) 6 (d) 7 (ii) Depreciation for 1st year = (a) 20,000 (b) 16,000 (c) 12,800 (d) 10,240 (iii) Depreciation for 2nd year = (a) 20,000 (b) 16,000 (c) 12,800 (d) 10,240 (iv) Depreciation for 3rd year = (a) 20,000 (b) 16,000 (c) 12,800 (d) 10,240.